Does the era of money end soon?

Some still prefer to use money, perhaps because they tend more towards the tangible nature of the material currency or because it provides confidentiality with transactions.On the other hand, the digital payments, which occur by passing a card or a few clicks on the mobile phone, have become more common.

In an article published by the New York Times, Aswar Brasad said to maintain the importance of money, many central banks try digital versions of their virtual currencies such as Bitcoin.It should be noted that these currencies are affiliated with private companies, while the state will ensure the issuance of this type of currency such as traditional currencies.

The writer emphasized that the central banks are planning to introduce these digital currencies within limited exchanges to be present along with money as another cash option, then their circulation expanded over time until they gain popularity and the era of money becomes from the past..

For its part, China, Japan and Sweden have started experimenting with the digital bank of the Central Bank, while the European Bank and the European Central are preparing to take their own experience.Indeed, the Bahamas offered the first official digital currency in the world.

On the contrary, the American federal reserve remains largely margin, as it is possible to miss to catch up with this knee..The United States should develop a digital dollar, not because of what other countries do, but because the benefits of the digital currency exceed the costs far.

The writer emphasized that one of the benefits of the digital currency is security, because the money money is subject to loss and theft, a problem that both individuals and companies suffer, while digital currencies are relatively safe..It should be noted that digital currencies can be exposed to electronic piracy.Currently, it can be managed using new technologies.

Moreover, digital currencies can serve the interests of the poor and who do not deal with banks.It is difficult to obtain a credit card if you do not have much money.In addition, banks impose fees on low -balance accounts.On the other hand, the digital dollar will give everyone, including the poor, the possibility of access to a digital payment system and a gateway for basic banking services..

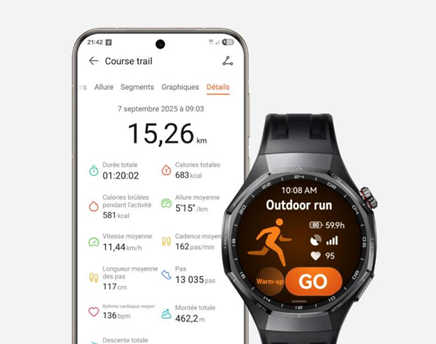

Mobile phone application

Every individual or family can own an account without fees and benefits with the federal reserve, linked to the mobile phone application to make some financial transactions.It is worth noting that about 97% of American adults have a mobile phone or a smartphone.To find out how this can help, the payments that the US government provided to families are taken into account as part of the motivational packages that they pumped in light of the outbreak of the Corona virus..

There are complications, or delays in obtaining these payments. They faced millions of low -income families and those who do not have bank accounts or direct deposit information registered with the Internal Revenue Department.The delay or loss of checks and discount cards sent by mail for many of them, and the fraudsters found ways to penetrate these payments.Central banks' accounts could have reduced fraud, and made the management of motivation easier, faster and safer.

The central bank's digital currency can be a useful political tool.Usually, if the federal reserve wants to stimulate consumption and investment, it can reduce interest rates and provide cheap credit.In the event that the economy suffers from chaos and reducing the federal reserve already a short -term interest rate, the options available to it are limited..However, if the replacement of cash with digital dollar occurs, the federal reserve may impose a negative interest rate by gradually reducing electronic balances in digital currency accounts, which is an incentive for consumers to spend and companies for investment.

The digital dollar will put an end to illegal activities that depend on suspicious monetary transactions such as drug trade, money laundering and terrorist financing, which may enable the removal of unorganized economic activities from shadow to become within the official economy, which leads to increasing tax revenues.

Risk

Certainly, there are potential risks to the central bank's digital currencies.For example, the digital dollar may pose a threat to the banking system.However, what if families transferred their money from regular bank accounts to the central accounts, considering them safer without paying any benefit?In this case, the Central may find itself in an undesirable position as it is forced to allocate credit, identifying sectors and companies that deserve loans.

But such risks can be managed.Commercial banks can audit customer accounts from the digital currency to keep the Central currency accounts, along with interest deposits accounts.Digital currency accounts may not directly help banks to reap profits, but they will attract customers who then can enjoy products, savings or loans.

To help protect commercial banks, restrictions can also be placed on the amount of money deposited in the central accounts, as did the Bahamas Islands.In addition, a digital currency can be designed for the recipient to use through various payment platforms, which enhances competition in the private sector, and encourages innovations that make electronic payments cheaper, faster and safer..

The loss of privacy, which is involved in the use of digital currencies, is another source of concern for the recipient.Even with protection measures to ensure confidentiality, no central bank will abandon the ability to check and track transactions.The digital dollar can threaten the remaining identity and privacy of commercial transactions.

The end of criticism is looming on the horizon, and it will have far -reaching effects on the economy, financing and society in general.The appearance of the digital dollar must be accepted, with the appropriate preparation and open discussion.